As a Finance Executive working with startups/scale ups, I have witnessed firsthand how founders/CEOs of these companies not only struggle navigating the fast-paced world of business, but are flooded with different financial metrics to track.

Through financial metrics are critical to track especially for a young business because it provides management with real-time insight, direction, and control, knowing what to track is as important as tracking.

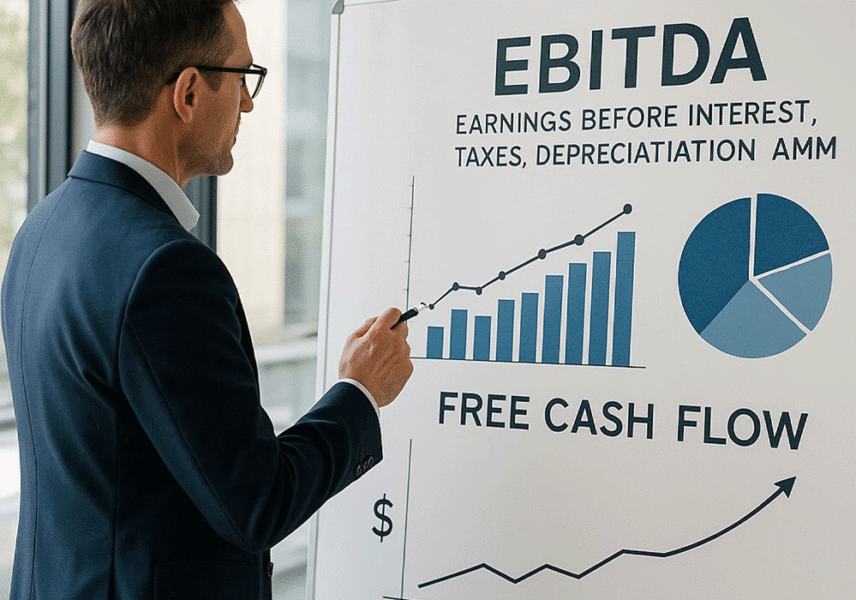

When it comes to measuring the true health and viability of a startup/scale up, two indicators consistently rise to the top: Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) and Free Cash Flow (FCF).

So, which one should a young business focus on? The answer depends on the strategic goals, stage of growth, and operational model of the business. Let’s break it down

Understanding the Metrics

EBITDA: A Snapshot of Operational Performance

EBITDA a metric from the Income Statement gives a clear view of a company’s operational performance without the effects of financing decisions, tax environments, and accounting assumptions about depreciation and amortization (net income minus interest, taxes, depreciation and amortization or operating profit plus depreciation and amortization).

However, EBITDA is not a measure of cash flow. It doesn’t tell how much cash a business is actually generating or how sustainable its operations are overtime.

Why it matters:

It highlights a company’s core profitability.

It’s a common metric for investors and lenders to compare performance across companies and industries.

It is relatively easy to calculate and track.

Free Cash Flow: The Cash That Really Matters

Conversely, Free Cash Flow, a metric from the Cash Flow Statement is the cash a business generates after accounting for capital expenditures (operating cash flow minus capital expenditure). This is what’s left over to reinvest in the business, repay debt, or return to shareholders.

Why it matters:

It reflects a company’s actual ability to generate value.

It's crucial for making strategic decisions such as hiring, scaling, product development.

It's a survival metric especially during lean times when access to capital is limited.

Which Should You Focus on as a Young Entrepreneur?

EBITDA: Ideal for Growth and Attracting Investment

In the early growth stages, EBITDA can be a useful tool. It helps:

Demonstrate operational efficiency to investors.

Show traction and scalability.

Benchmark against industry peers.

If a business is pitching to VCs or negotiating a line of credit, EBITDA will likely be one of the first metrics they examine.

Free Cash Flow: Critical for Longevity and Discipline

As the business matures or its bootstrapping Free Cash Flow becomes king. A profitable EBITDA can still mask a cash-poor business. Without positive FCF, you might struggle to meet payroll, pay suppliers, or weather unexpected downturns.

Free Cash Flow forces a company to run a disciplined, financially sound business, ensuring your growth doesn’t come at the cost of liquidity or long-term viability.

Striking the Right Balance

As a young entrepreneur, the smartest move is to understand both metrics deeply but focus on the one that aligns with the business’s immediate needs:

| Stage | Metric to Prioritize | Why |

|---|---|---|

| Early-stage/startup | EBITDA | Attract investors, prove core performance |

| Post-revenue/cash-sensitive | Free Cash Flow | Ensure sustainability, manage growth |

| Preparing for exit or sale | Both | Buyers/investors will look at both metrics |

Conclusion

In the end, EBITDA might get you noticed, but Free Cash Flow will keep you in business. For young entrepreneurs, understanding the story both metrics tell and how they fit into the strategy is critical. Focus on the right one at the right time, and the business will be in a stronger position to grow, scale, and thrive.